-

23 November. 2021

Adsyou .Net ... Factoring ...

What is factoring?

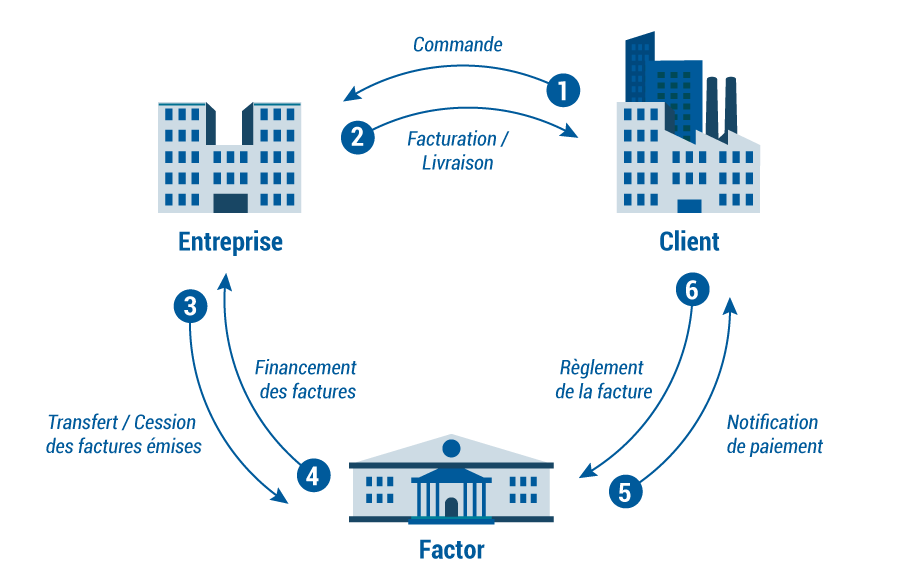

It is a solution that makes it possible to finance the cash flow of companies by benefiting from an advance payment of their invoices before the due date. For this, invoices are transferred to a factoring company (called Factor or Factorer) which is in charge, as part of a factoring contract, of managing the company's customer item. The company takes care of all the recovery and debt collection operations.

The main interest of factoring is to be able to benefit from a source of financing to replace or supplement conventional bank loans.

Factoring offers 3 complementary services: the financing of receivables, the management of the receivables (Management of buyer accounts, reminder, amicable recovery and litigation of invoices if necessary) and the guarantee against unpaid invoices.

Factoring,is a financial management technique by which a financial company (the factor) manages, as part of a contract (factoring contract), the customer item of a company by financing its customer invoices, recovering its receivables, guaranteeing claims on its debtors, lettering and imputing payments.

The factoring service is remunerated by a commission on the amount of invoices, service commission and financial commission.

The term factoring, although an anglicism, is still commonly used in France to designate factoring operations.

New line factoring brings together all new factoring dematerialized offers

International factoring

International factoring includes import factoring operations and export factoring operations.

International factoring is constantly developing, with its share in global factoring constantly growing. Every year in the analysis of the factoring market, we observe the increasing share of international factoring.

International factoring

Factoring with recourse is a factoring technique that makes it possible to finance invoices without guarantee, i.e. receivables without credit insurance given by the factor. The company remits receivables as factoring. In case of non-payment on the due date, the factor turns to the company to be reimbursed for its financing.

With this type of contract, it is the company that retains the management and responsibility for the proper payment of its customer, usually through the use of credit insurance taken out with a credit insurer.

In the event of non-payment, the company will be compensated by its credit insurance contract and will therefore be able to repay the factor that has made cash advances.

Factoring without recourse

In a factoring without recourse contract, on the contrary, the factor is "without recourse" towards the company it has financed if it experiences an unpaid. He will not be able to come and seek the funds advanced, nor will he be able to finance the guarantee fund.In practice, it is more complex, because the without recourse is supposed to apply in the event of unpaid due to the insolvency of the customer or a cessation of payment. In these cases, the factor is indeed "without recourse" to the company, but it can circumvent this impediment by using other grounds to qualify the non-payment of the invoice.

In these cases, the "no recourse" may not be applied as intended in the factoring contract.